What to do with a torn bill

author

Alexander Pratt

A source

Krylatskoe.ru

Let's be realistic. If you have a 100-ruble bill torn to shreds, then it is much easier to throw it away than to rush around the banks trying to somehow attach it.

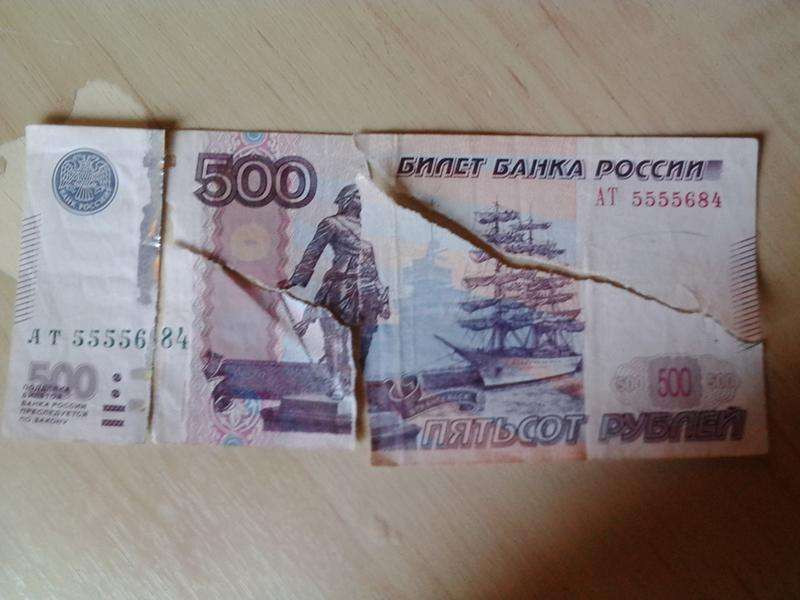

But what if the trouble happened with a banknote of a solid denomination. For example, closing your wallet with a zipper, you accidentally “chewed” a part of a 1,000-ruble bill or, even worse, 5,000 rubles. How to be in such a situation and what can be done to make your family budget suffer as little as possible?

The first thing to try is tape it. To begin with, the banknote needs to be smoothed, since after processing with an iron it will be much easier to glue. True, you cannot "iron" the bill itself. Better to lay a sheet of paper interlayer.

Important!

Having smoothed the bill, the ends must be carefully connected and sealed with transparent matte tape. If the gap was in one place and the bill was glued neatly, you can even “feed” it to an ATM with a cash-in function or an express payment terminal.

By the way, you can try to slip it in the store, just choose a large retail chain. As a rule, cashiers are less picky there.

You can, in case of problems, remind you that, according to the law, they are obliged to accept bills with minor damage.

How to glue pages

The first thing that comes to mind when you see a torn page is scotch tape. But you cannot use it for repairs. The glue with which the tape is smeared corrodes the paint, mold and yellow spots form under it, it peels off along with the letters. A special translucent invisible tape for gluing money will do. It is sold in a stationery store and costs around 200 rubles. If you cannot find the tape, use thin strips of tracing paper and PVA.

The second way to fix a torn page is to staple it directly at the break. To do this, lubricate the PVA paper in the torn place, without going beyond the boundaries of the gap, and then align the torn edges as carefully as possible. On both sides of the sheet, along the gap, we apply thin tissue paper (it does not need to be glued), and on top - ordinary paper for printing. Then the book is sent to the press. After 6-12 hours, we remove the paper, and gently smooth the place of the gap. After such a procedure, the defect is almost invisible.

To remove a greasy stain from a book, sprinkle it with talcum powder and iron it through the paper.

Is the torn bill valid

Torn money is valid in many cases, but they do not want to accept it everywhere, and if the damage is significant, they must be exchanged at the bank.

Types of spoiled bills:

- Slightly torn (ripped at the bend or missing an edge);

- Torn in half or several pieces (for example, a child tore);

- Spoiled with paint or accidentally spilled coffee / juice;

- Shabby with old age or frayed due to washing, being in a jeans pocket, or multiple folding;

- Partially burnt;

- With a manufacturing defect;

- Drawn.

If 55% of the area and the bill number are preserved, then it can be replaced or, in case of minor damage, pay for goods and services.

What to do if a bill is torn:

- Torn in two - try to restore (glue with tape, glue, papyrus) and pay for goods / services.

- Glue it carefully with tracing paper or glue and try to deposit it into the terminal, about 60% of devices can accept that kind of money.

- If the bill is glued together, and the cashier or terminal refuses to accept it, then you need to contact the bank branch, where they must replace it.

- When it comes to small denominations, it makes sense to put them aside and, when the normal amount has accumulated, go to the bank.

How to glue correctly

There are several ways to restore paper money so that no traces of repair remain on them.

Scotch

Suitable if the banknote is not badly damaged. Otherwise, the restoration will be conspicuous and clumsy.

> Progress of the recovery operation:

- money is placed on a flat surface;

- measure the length of the damage;

- cut off a piece of adhesive tape, which is equal in size to the length of the gap;

- gently apply scotch tape to the place of the rush.

In stores that sell office supplies, you can buy special duct tape for repairing money.

Glue stick

The method is effective for banknotes torn into 2 parts. Procedure:

- A glue pencil is drawn along the torn edges of the bill.

- The composition is allowed to dry for 3-4 minutes, then the manipulations are repeated.

- Parts of the banknote are placed on a sheet of paper. Carefully adjusting the scraps, the banknote is sealed. In this case, make sure that the picture on the front side completely coincides.

- Using a cotton pad or swab, apply a little starch, talcum or chalk to the bonding site. This will prevent the note from clinging to other currency in the wallet.

After 30 minutes, the glue will dry completely, the joint will become invisible.

PVA

This gluing method takes longer than the previous ones. But the seam turns out to be invisible. The funds that will be needed to carry out the operation to save the banknote: iron, waxed paper or glass bottle, thick PVA glue.

Bonding procedure:

- Using a toothpick or a match, glue is applied to the damaged end. If the composition accidentally gets on the bill, it is gently wiped off with a dry napkin or rag.

- The banknote is placed on wax paper or a bottle, its parts are butt-sealed. It should be combined exactly according to the pattern, without overlap.

- The joints are fixed by running the spout of the heated iron along them.

In a few minutes, the bill is ready.

Where and how can a torn bill be exchanged

Do not know in which cases banks accept damaged banknotes, and in which not? We will tell you how to exchange a torn or painted note without commission.

Try to pay with a torn bill in a store. According to the Federal Law "On the Central Bank of the Russian Federation", trade and service organizations are required to accept money:

- dirty or worn out;

- frayed or torn;

- with small holes, punctures;

- with inscriptions, spots;

- without corners, with missing edges.

Stores hand over such bills to banks. It is forbidden to give the client change with a torn banknote!

Bank exchange

Carry money with serious damage directly to the bank (Sberbank and any other commercial bank). The Federal Law "On the Central Bank of the Russian Federation" states that the following are subject to mandatory exchange:

- banknotes preserved by at least 55%;

- glued banknotes;

- defective banknotes;

- money that has lost / changed color under UV rays.

The main condition for the exchange: on any of the fragments, the banknote number must be clearly read.

People advise: Glue the torn banknote with tracing paper and glue (never tape it!). "Feed" the "refurbished" money to an ATM / terminal - put it on your bank account or on your phone. This method works in 60% of cases!

Is it possible to change a torn banknote in a commercial bank?

Let us refer to the Directives of the Bank of Russia “On the signs of insolvency and the rules for exchanging banknotes”. The document contains the wording "credit institutions", meaning all banks registered in the Russian Federation, except for the Central Bank (Bank of Russia).

In addition to the torn banknote, take your passport with you.

How to exchange a torn bill without commission?

The service fee was canceled back in 2010. Now any requirement to pay for an exchange is illegal.By the way: for four years now, the condition of a mandatory examination, certifying the authenticity of damaged banknotes, has not been in effect. It turns out that you should not have any obstacles to replacing torn money.

I was appointed a commission to determine the authenticity - is this legal?

In difficult cases, the bank has the right to conduct an examination (we emphasize: a free examination). It is more likely that the procedure will be carried out if:

- the banknote is torn to a quarter of its area;

- it is glued together from ten fragments of a banknote with one number;

- it is glued together from fragments of different banknotes of the same denomination.

The commission can take up to 10 business days.

The way the examination proceeds is well described in the following comment:

I was refused an exchange. What to do?

Contact another bank. Refused there too? Has the right to complain about the actions of employees of the institution. Leave a message on the Central Bank website - indicate your full name, describe the problem. Within a month, you will definitely be answered.

Which banknotes cannot be exchanged?

Significantly damaged banknotes are not legal tender. First of all, these include banknotes with a safety less than 55%.

All negative reviews on the Internet regarding the issue of how to exchange a torn bill were left no later than 2013. Customers of most commercial banks say that today there are no problems with replacement.

Save and share information on social networks:

How to use damaged money

Damaged banknotes can be used in the same way as ordinary ones. Such money will not be accepted only if it is damaged too much. Moreover, the signs of the solvency of banknotes and coins are strictly indicated by the Central Bank of Russia, which in 2006 issued special Instructions.

Banknotes are subject to acceptance in all types of payments:

- Have small holes or punctures, with damaged edges and lost corners, tears;

- On which there are various inscriptions, impressions of stamps;

- The appearance of which is spoiled by minor scuffs, dirt, small stains (from paint, oil, etc.);

- Faded (for example, after washing), provided that the image and number remain unchanged and clearly visible.

The Central Bank divides all banknotes into three degrees of dilapidation. Money that has the above signs belongs to the 1st degree of dilapidation. Payment institutions may not accept 2nd and 3rd degree bills.

Things are worse with ATMs. They do not accept banknotes with large gaps, even if they have been glued together. However, there is a chance that the ATM will accept just a little frayed bills - it depends on the settings of the reader.

Banknotes are subject to acceptance in all types of payments:

- Have small holes or punctures, with damaged edges and lost corners, tears;

- On which there are various inscriptions, impressions of stamps;

- The appearance of which is spoiled by minor scuffs, dirt, small stains (from paint, oil, etc.);

- Faded (for example, after washing), provided that the image and number remain unchanged and clearly visible.

The Central Bank divides all banknotes into three degrees of dilapidation. Money that has the above signs belongs to the 1st degree of dilapidation. Payment institutions may not accept 2nd and 3rd degree bills.

Things are worse with ATMs. They do not accept banknotes with large gaps, even if they have been glued together. However, there is a chance that the ATM will accept just a little frayed bills - it depends on the settings of the reader.

The main methods of gluing torn banknotes

In order to glue a torn bill, there are several simple, but quite effective ways.

Method number 1

In this situation, the most common stationery tape will come to your aid. It should be used if the defect is small.In the opposite case, such a fix will look rather rude and conspicuous.

In order for the seam to look more neat, the following procedure must be followed:

- Place the bill on a flat surface.

- Measure the length of the break.

- Cut a piece of tape equal to the gap length of the bill.

- Place tape over the torn area. This should be done very carefully so that creases do not form.

Method number 2

In this case, you only need a glue stick:

- Take a glue stick and run it only along the ends of the gap.

- Let dry a little. After 2-4 minutes, this operation should be repeated again.

- Place the two pieces of the bill on the paper. Connect them carefully.

Using a stationery brush or cotton swab, apply a little dust (talc, starch or chalk) to the bonding areas.

Let the glue dry for half an hour. After the specified time has elapsed, you can safely go shopping, since the junction is almost invisible.

Method number 3

To begin with, glue should be applied to the torn end of the bill. This can be done with a match or a toothpick.

Place the bill on the bottle and join the halves butt to each other. Try to accurately align the pattern and avoid overlap.

- Lock the joints and run over them with the spout of the hot iron.

- Wait a few minutes for everything to cool down.

Additional tips and tricks

A few tips for those who first took up the restoration:

- It is better to give valuable old books, rare editions to a restoration workshop. Craftsmen will be able to restore the original appearance of the rarity, extend the life, preserve the price and artistic value of the publication.

- Do not use adhesive tape for restoration - the packing tape will soon peel off, the sealing will ruin the text.

- Stationery glue is not suitable for repairing books - glued pages break and become brittle. The glue gradually exfoliates and crumbles along with the sheets.

- For sewing a book, it is better to take not cotton thread, but threads for knitwear, waxed linen or for stitching.

It is often easier not to glue and repair the book, but to use metal or plastic bindings and rings to hold the pages together. This is how you can restore recipe books and useful tips.

Old books can be prolonged by keeping editions for children and grandchildren. Good books are a pleasant way to spend your leisure time, many pass on valuable tomes from generation to generation. Books remind of old friends who donated the volume, of important events in life. The ability to restore old editions and children's books is useful for everyone who loves to read and has a home library.

Share link:

What if the store does not accept old banknotes?

It is not uncommon for shop assistants to refuse to accept old money. Such a refusal is legitimate if the banknote you offered belongs to the 2nd or 3rd degree of dilapidation. You will have to exchange such money at the bank.

But if you are confident in the solvency of your money, the seller has no right to refuse the transaction.

Refusal does not entail any administrative penalty, so the seller will have to be influenced only verbally or through court. Naturally, litigation even over a couple of thousand rubles is not profitable for anyone, so it is easier to find another store or exchange worn bills in a bank.

It is not uncommon for shop assistants to refuse to accept old money. Such a refusal is legitimate if the banknote you offered belongs to the 2nd or 3rd degree of dilapidation. You will have to exchange such money at the bank.

Refusal does not entail any administrative punishment, so the seller will have to be influenced only verbally or through court. Naturally, litigation even over a couple of thousand rubles is not profitable for anyone, so it is easier to find another store or exchange worn bills in a bank.

According to the decree of the Central Bank, shops are required to accept banknotes with minor damage. An exception is made up of torn money that has lost signs of solvency. For example, if a half remains from the form or several parts are torn off at once.

The regulation regarding damaged banknotes is contained in the decree No. 1778 of the Central Bank of the Russian Federation. Stores are not entitled to prohibit paying for purchases with a bill if it is slightly torn within the 1st degree of dilapidation. This is a violation of the Central Bank decree, Art. 426 and 445 of the Civil Code of the Russian Federation. There are no penalties for these violations. You can challenge the seller's actions either by persuasion or in court.

The position of the legislation on where to change the torn banknote is unambiguous. All commercial banks are obliged to accept damaged forms of the Central Bank and replace them at the request of citizens. You don't even need to have documents for exchange. The procedure is fast and simple. It is enough for a citizen to appear at the branch of the nearest bank, hand over the spoiled rubles to the cashier and pick up a new bill. The main thing is that the bill number is readable on at least one piece of paper.

By law, banks have the right to appoint an expert assessment of a banknote if it:

- Damaged by more than ¼ of the entire area;

- Glued from several fragments, even with the same serial number;

- In a state where it is impossible to authenticate or verify license plates.

The examination is carried out solely to establish the authenticity of the banknote. Until 2010, the procedure was paid, until 2014 it was obligatory for all money that was brought in for replacement. Now the examination is free, it is carried out in exceptional cases by the decision of bankers. The verification period is 10 working days.

The law also regulates where to deposit damaged foreign currencies. As with the 1,000-ruble banknote, Russians can apply to a bank for a replacement. In this case, there are several nuances. The bank has the right to refuse to exchange banknotes, charge a commission of 3-10% of the denomination of the banknote. It is better to immediately contact large institutions.

- Purchase rubles in the amount of a foreign banknote at the current exchange rate;

- Crediting funds to a bank account, plastic card;

- Transfer of a banknote to another bank that issued it, with compensation.

The exchange rules are similar for all foreign currencies. Euros and dollars are exchanged more readily than others. In addition, you are more likely to be replaced at the bank of which you are a client. For account and card holders, the terms of service are more loyal.

Frequently asked questions and answers to them

Will the ATM accept a torn bill?

If the bill is carefully glued, then about 60% of ATMs and terminals can accept it.

Tapered bills may not be accepted in self-service devices.

How to seal a torn bill on your own?

There are several options to glue money together:

- A thin strip of transparent tape on one or both sides;

- A neat strip of papyrus or tracing paper;

- We use regular / quick-drying glue so that the seam is barely noticeable (if the denomination is large, it is better not to risk it).

What if the ATM dispenses a torn bill?

The ATM should not issue damaged money, but if this happened, then the algorithm of actions is the same as with any other torn banknote.

Hello Ilona! According to the standards of service and operation, self-service terminals should not accept banknotes with defects. That is, not only tears, but also inscriptions, stamps, etc. that were not foreseen by the design. At the same time, an ATM is a technical device. Accordingly, the probability that he will accept the torn bill exists. The main thing is to renew its visual integrity. For example, gluing the gap. True, it should be borne in mind that there are no guarantees of acceptance of such a banknote.

Separately, we note the correct replacement of banknotes with defects. Their replacement is carried out by banks. Everyone on the territory of the Russian Federation.Whether it is a state-owned credit institution or a fully commercial one. In practice, not all of them accept torn bills. Therefore, we recommend that you immediately contact the Sberbank branch. First, they have a loyal approach to the procedure for replacing the considered banknotes. Secondly, there are structural subdivisions of this credit institution in almost every settlement of the country.

The Bank of Russia has identified the signs of worn-out banknotes - corresponding changes to the Regulation of the Central Bank of the Russian Federation No. 318.

Banks are obliged to accept worn-out banknotes without restrictions, but they are not allowed to issue them to customers and must deliver such banknotes to the Bank of Russia. Previously, commercial banks sorted banknotes on the basis of dilapidation at their discretion, now the Central Bank has determined, with millimeter accuracy, possible flaws leading to the rejection of banknotes.

At the request of the regulator, banknotes with surface contamination, leading to a decrease in the brightness of the image by eight or more percent, are recognized as dilapidated; and also partially lost the paint layer as a result of abrasion or discoloration.

Banknotes that are not suitable for use: have gaps along the edge, the length of each of which is seven or more millimeters; having one or more through holes (punctures), the diameter of each of which is four or more millimeters; have lost one or more corners, the area of each of which is 32 or more square millimeters; lost edges, as a result of which the dimensions of the banknote in length or width have decreased by five or more millimeters.

Banknotes with extraneous inscriptions consisting of more than two symbols are also considered dilapidated; one or more extraneous drawings (stamp impressions); one or more contrasting spots, the diameter of each of which is five or more millimeters.

Banknotes that have lost their integrity and fastened with adhesive tape are also recognized as dilapidated.

How to restore the cover

Book covers often have corners jammed. A good way to restore them is to saturate them with superglue. The corners will become rigid and will not wrinkle. This method is also suitable for children's books made of thick cardboard.

If the cover has fallen into disrepair or has lost some part, turn on your imagination. Make a blank out of thick cardboard. Wrap the blank with paper that matches the color, so that one side of the cardboard is completely covered, and on the other side of the blank, the edges of the sheet are bent by 3-4 centimeters. Decorate to your liking.

You can print an exact copy of the previous cover on a color printer, or take elements of the old one and make an author's collage.

Why they can refuse and what to do in this case

Changing money is not always as easy as described above. Indeed, situations often arise when the presented fragments may be deemed unsuitable for replacement.

When the refusal is legal

Cases of lawful refusal and recognition of money as not participating in circulation are described in detail in the above Instruction, which is guided by the bank's specialists. Therefore, if the quality of the presented fragment does not meet the established standards, it will not be possible to replace it, for example, in the following cases:

- the fragment does not match the set size;

- the denomination of the bill is not clear from it, and its number is missing;

- there are traces of paint used to detect theft on the banknote;

- several small fragments from different banknotes were presented;

- presented two halves of banknotes of different denominations.

In these and similar cases, the refusal will be lawful.

What to do in case of illegal refusal to replace

The Bank of Russia is in charge of the money replacement procedure. Therefore, in case of misunderstanding, you need to contact there. It also accepts complaints about bank divisions that unlawfully refused to replace a torn banknote. To file a complaint, you need the following:

- write an official statement asking for the replacement of the bill;

- demand an official refusal to replace with reference to legislation.

The received motivated refusal must be accompanied by:

- photocopy of your passport;

- fragments of a torn or dilapidated bill.

This set of papers, together with a complaint about the refusal to replace the banknote, must be transferred to the Bank of Russia. Based on the results of its consideration, a decision will be made to replace the money or to reject the complaint.

If the money is torn, and they are not recognized when carrying out monetary transactions, you should not rush to refuse them. You can replace a banknote in a bank, which will not be difficult.

Is it possible to exchange a torn bill at the bank

What money is accepted for exchange:

- Torn, burnt, cut off, painted, if one whole part of the banknote with an area of 55% or more has been preserved;

- Glued from several pieces, one of which is more than 55%;

- Two halves of the same denomination are connected, each not less than 50% of the original size;

- Faded, discolored (by the sun), if the underlying data can be seen;

- Banknotes with manufacturing defects.

How to exchange a torn bill:

- In order to quickly exchange torn money, it is advisable to find all parts of the bill and apply to the bank branch with them. The presence of all parts will significantly speed up the exchange process; expertise is not required.

- Find the nearest bank branch, contact the cashier, passport or additional documents are not required.

- The cashier inspects the damage, if the money is subject to exchange and there is no doubt about the authenticity, the bank representative issues a new banknote.

- In difficult situations, the head of the department is involved in the exchange process, if he cannot confirm the authenticity of the money, then an examination is appointed.

Where and how to change and what to do with a torn banknote

Sometimes we are faced with a situation when unpresentable money falls into our hands. Most often, these are banknotes of a small denomination of 10 and 50 rubles, unnoticed among other notes from change or accidentally washed along with clothes.

It is quite easy to get rid of them in small shops or stalls. But what if a large bill of 500, 1000 or even 5000 rubles was damaged?

Let's try to figure out how various damages affect the solvency of the bill and what to do to return the spoiled money.

Spoiled money remains valuable if it shows dignity and watermarks. But the Central Bank's torn ticket will not be accepted by shops and ATMs. This article will discuss what to do with a torn bill.

Small denominations can be accepted in stores. A large amount of damaged money will have to be replaced through a bank or repaired. There are several ways to recover torn paper money.

What money is accepted in exchange centers and whether the value will remain with them depends on the degree of damage:

- Minor tear or fouling. They can be used to pay in stores, bills do not raise questions from sellers.

- The gap is too strong to pay for purchases with letterhead. Owners have the right to exchange such banknotes at banks.

- The banknote loses signs of solvency. This means that it is impossible to make out signs on it, confirmation of authenticity with watermarks, more than 55% of the area of the paper is damaged. A bill with an unreadable number will not be accepted or exchanged anywhere, it cannot be restored.

How to glue a bill || How to glue a bill

What to do with a torn bill? In case the bill is torn in half, you can go to some tricks to extend its solvency for a while. It's about gluing the money torn in half.

It should be taken into account that the gluing will not last long, especially on worn-out banknotes, but in the store it may be noticed. Then it will have to be carried to the bank for exchange.

There are several ways to glue a torn bill:

- A thin strip of transparent tape.If necessary, tape can be applied on both sides;

- We glue "Moment" or PVA. Both edges of the bill should be smeared with a thin layer of glue and try to connect the halves so that the seam becomes as less noticeable as possible. The chance to get rid of the money glued in this way in the store is higher;

- Instead of tape, use a strip of tracing paper or tissue paper and glue.

After gluing and drying, it is necessary to bend the bill in such a way that the seam or strip of scotch tape does not fall on the fold. Since paper money is often crumpled, you should be more careful with the recovered banknote.

How to use damaged money

Damaged banknotes can be used in the same way as ordinary ones. Such money will not be accepted only if it is damaged too much. Moreover, the signs of the solvency of banknotes and coins are strictly indicated by the Central Bank of Russia, which in 2006 issued special Instructions.

Banknotes are subject to acceptance in all types of payments:

- Have small holes or punctures, with damaged edges and lost corners, tears;

- On which there are various inscriptions, impressions of stamps;

- The appearance of which is spoiled by minor scuffs, dirt, small stains (from paint, oil, etc.);

- Faded (for example, after washing), provided that the image and number remain unchanged and clearly visible.

The Central Bank divides all banknotes into three degrees of dilapidation. Money that has the above signs belongs to the 1st degree of dilapidation. Payment institutions may not accept 2nd and 3rd degree bills.

Things are worse with ATMs. They do not accept banknotes with large gaps, even if they have been glued together. However, there is a chance that the ATM will accept just a little frayed bills - it depends on the settings of the reader.

Financial expert Dmitry Zotov tells in detail and clearly how damage is determined on banknotes and coins, how and where they can be applied or exchanged.

What if the store does not accept old banknotes?

Note!

It is not uncommon for shop assistants to refuse to accept old money. Such a refusal is legitimate if the banknote you offered belongs to the 2nd or 3rd degree of dilapidation. You will have to exchange such money at the bank.

But if you are confident in the solvency of your money, the seller has no right to refuse the transaction.

Refusal does not entail any administrative punishment, so the seller will have to be influenced only verbally or through court. Naturally, litigation even over a couple of thousand rubles is not profitable for anyone, so it is easier to find another store or exchange worn bills in a bank.

Examination of damaged banknotes

When it is not possible to visually determine the state of banknotes, the bank employee is obliged to send them for a special examination. This procedure is free of charge and is carried out at the regional offices of the Bank of Russia.

You should have a warrant and a second copy of the application containing an imprint of the cash register stamp and the cashier's signature. Banknotes are sent to the place of examination within five working days, the procedure itself takes the same amount of time.

If these banknotes are recognized as genuine and a decision is made to replace them with new ones, you will receive them at the same bank, depending on the method chosen.

Cutting and gluing of banknotes

The Bank of Russia recognizes fragments of at least 55% of the original area of the banknote as “subject to acceptance by credit institutions and banks” or “solvent banknotes subject to exchange”. That is, such banknotes can be exchanged at the bank for new ones.

Examples of such banknotes are burnt, exposed to corrosive environments, charred and rotted notes.

An example of a banknote to be exchanged at a bank:

Fraudsters cut Russian rubles in such a way that about 40% of each banknote remains.From these separate fragments of the original banknotes of the Bank of Russia, one new banknote is glued together with thin adhesive tape, which in size completely coincides with the original banknote. Thus, the bill has all the security features, including machine-readable ones.

Equipment with automatic authentication controls the authenticity precisely by machine-readable security features. This is the principle used by terminals for accepting payments, ATMs, automatic detectors, banknote counters, most banknote sorters that accept glued bills of different denominations as normal (authentic).

These cut and then glued bills, which got into the ATM and the payment terminal, can be found directly in the bank when processing the cassette with all the accepted cash.

How can you distinguish a “fake” bill from a real one?

You can recognize the "gluing" of bills only if you compare the two serial numbers located on the right and left (they do not match).

An example of cutting and gluing a bill:

An example of equipment with the function of verifying serial numbers is the Cassida Zeus banknote counter-sorter.

Advice!

According to the legislation of the Russian Federation, the manufacture of "glues" is fraudulent, not counterfeiting.

Thus, the production and sale of banknotes made from parts of genuine banknotes is not formally covered by the offense provided for in Article 186 of the Criminal Code of the Russian Federation (“Production of counterfeit bank notes of the Central Bank of the Russian Federation for the purpose of selling”).

As a result, the Bank of Russia classifies "gluing" as "insolvent banknotes", that is, from a legal point of view, they are not counterfeit or fake.

By the way, the punishment under Art. 186 of the Criminal Code of the Russian Federation - a prison term of up to 15 years, a fine of up to 1 million rubles. At the same time, for making “glues” the malefactors are punished under the article on fraud under Article 159 of the Criminal Code, according to which the maximum prison term is 10 years.

Where can you make a replacement?

On the one hand, the answer to the question of what to do if you tore a banknote is obvious - in the bank. On the other hand, you should change money only in that financial institution that has a license from the Central Bank of the Russian Federation and is registered accordingly. You can visit a branch of Sberbank or any other commercial, all of them will replace without any problems if the condition of the note is sufficient to determine its authenticity.

In some cases, when in doubt, the bank may start checking the authenticity of the money. It is free for the client and lasts no longer than two weeks. After confirming the status of a genuine currency, the banknote will be changed.

First of all, if a person has only a small part on his hands

An important rule that in some cases can negate all attempts to get your money back through the bank

Also, if the series and the number of the monetary unit are completely damaged, the bank has the right not to change it, since in order to make an exchange, the financial institution must check the bill for authenticity.

If there is a stamp “Sample” or “Test”, money will not be accepted for exchange. However, such funds do not circulate among people, since they remain only within the banking organization and can only enter the free market as a result of an error.

If the banknote is missing more than a third of its original size. Such a bill is not considered intact and cannot be exchanged.